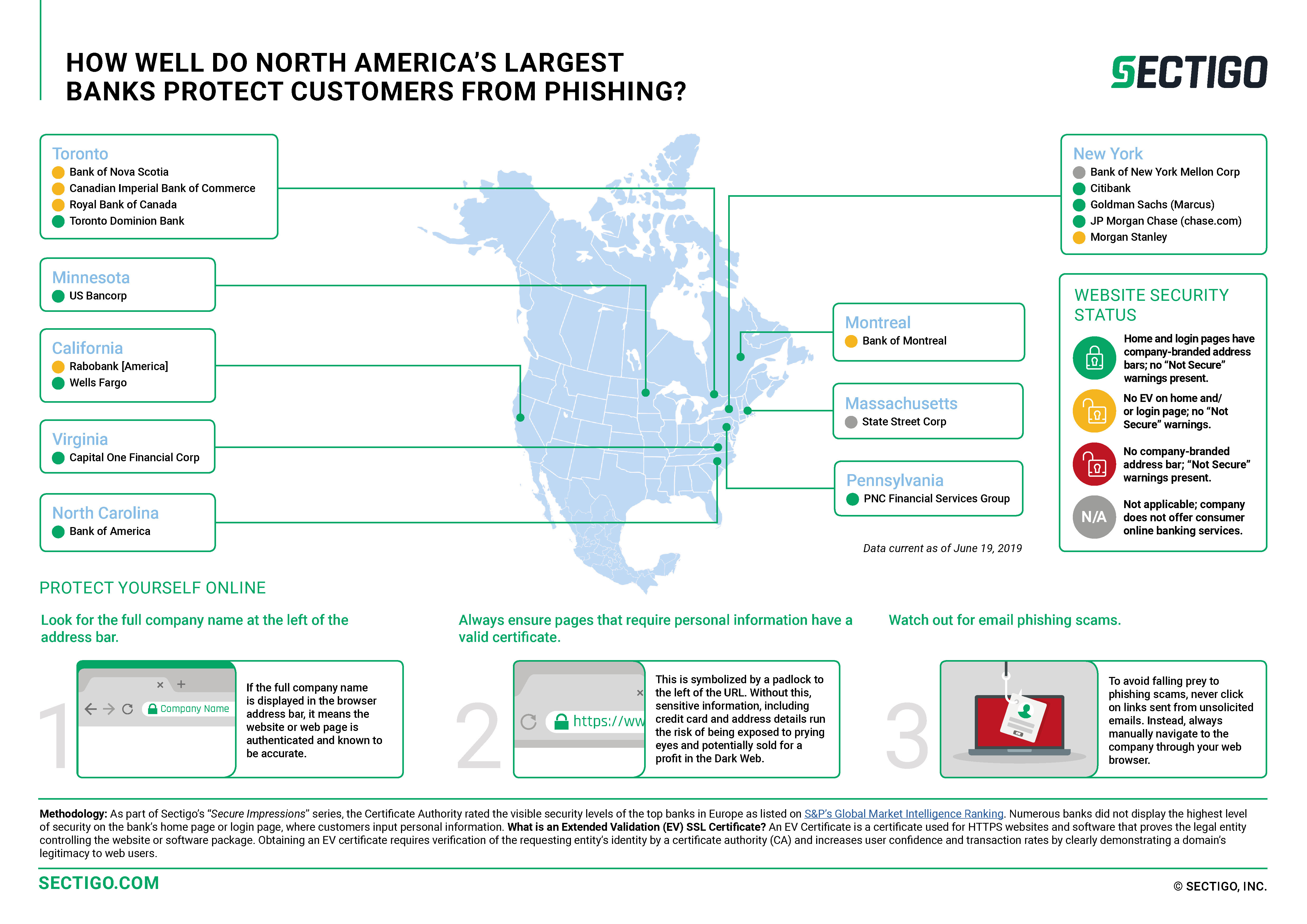

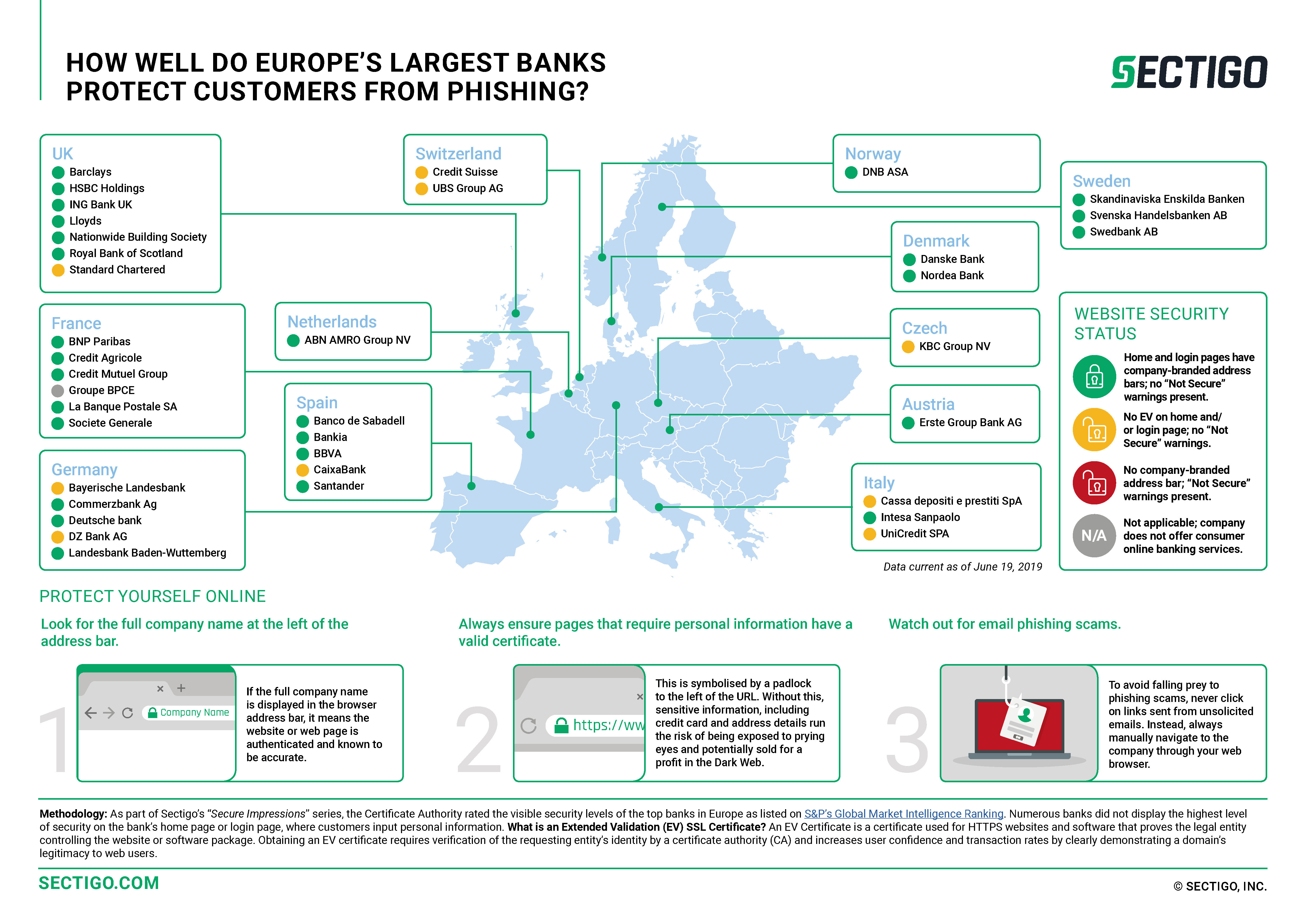

How Well Do the Largest Banks in North America and Europe Protect Customers from Phishing?

In our latest Secure Impressions: Online Banking Study, Sectigo reveals how well the world's largest banks in North America and Europe ensure and demonstrate security of customer information on their online banking websites. Sectigo rated websites based on the presence of SSL certificates; verifications provided by a CA, which confirm that a website is authentic and legitimate.

Given the extent and value of personal and financial data managed by the world’s leading financial services companies, and that 76% of data breaches are financially motivated, it is critical for banking customers to feel assured of the authenticity of their banks' websites. In fact, 90% of consumers report worrying about having their online financial accounts hacked.

In our latest Secure Impressions: Online Banking Study, Sectigo reveals how well the largest banks in North America and Europe ensure and demonstrate security of customer data on their online banking websites. Sectigo rated websites based on the presence of SSL certificates, which confirm that a website is authentic and legitimate. We found that a notable percentage of banks left customers vulnerable to phishing scams, but that there is some good news: every bank studied had some form of SSL certificate on its home and login pages.

In North America, 40% of applicable banks studied did not receive the highest rating, exemplified by the use of EV SSL certificates to demonstrate the website’s true, authenticated identity.

In Europe, 25% of applicable banks studied did not receive the highest rating, exemplified by the use of EV SSL certificates to demonstrate the website’s true, authenticated identity.

Phishing and pretexting represent 93% of breaches. Extended Validation (EV), indicated by a company-branded address bar, helps to increase site transactions and protects users against phishing, serving as a best-practice security measure for businesses online.

A 2018 study found that 8 out of 10 people report that the presence of EV influences their perception of a brand or company and half indicate it has a significant influence. The findings above serve as a reminder for banks to pay attention to their online presence, not only to protect customers from phishing, but also to convey that "extended" protections are in place.