Forty Percent of the Largest Banks in North America Do Not Use Best-Practice Security Measures to Protect Against Phishing

Sectigo today released findings from its latest Secure Impressions: Online Banking Study, revealing how well the largest banks in North America and Europe ensure and demonstrate security of customer information on their online banking websites. The study found that a notable percentage of banks left customers vulnerable to phishing scams, but that all banks do use some form of SSL certificates.

Sectigo Analysis Reveals Gaps for Security-Conscious Customers Using Online Banking Services

ROSELAND, N.J. – June 27, 2019 – Sectigo, the world’s largest commercial Certificate Authority (CA) and a provider of purpose-built and automated PKI management solutions, today released findings from its latest Secure Impressions: Online Banking Study, revealing how well the largest banks in North America and Europe ensure and demonstrate security of customer information on their online banking websites. The study found that a notable percentage of banks left customers vulnerable to phishing scams, but that all banks do use some form of SSL certificates.

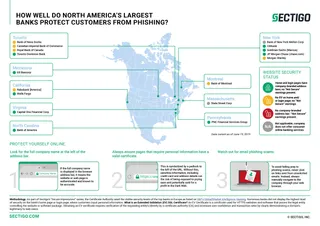

Sectigo rated websites based on the presence of SSL certificates—verifications provided by a Certificate Authority (CA), which confirm that a website is authentic and legitimate. In North America, 40% of banks studied did not receive the highest rating, awarded in part for the use Extended Validation (EV) certificates to demonstrate the website’s true, authenticated identity. In Europe, 25% of banks did not receive the highest rating. Sectigo calculated percentages based on the number of banks offering consumer online banking services. (See complete findings.)

Sectigo rated each bank’s website according to the type of certificates used to secure the home and login pages for the banks’ online banking service. Full marks (green status) were awarded for the presence of Extended Validation (EV) SSL certificates and the maximum available level of identity verification on the home and login pages. Websites without EV certificates on the home and/or login pages received a lesser rating (yellow status). No banks in the study displayed “Not Secure” warnings (red status).

Given the extent and value of personal and financial data managed by the world’s leading financial services companies and the fact that 76% of data breaches are financially motivated, it is critical for banking customers to feel assured of the authenticity of their banks’ websites. In fact, 90% of consumers report worrying about having their online financial accounts hacked.

Sectigo has conducted similar Secure Impressions studies for the world’s top travel sites, as well as the e-commerce sites of the most popular UK retailers.

“Online criminals routinely use counterfeit websites to trick consumers into unknowingly providing valuable information such as account logins, credit card numbers, and personally identifiable information that can be used for identity theft,” said Tim Callan, Senior Fellow, Sectigo. “To give customers peace of mind, financial institutions can deploy Extended Validation SSL certificates to communicate the bank’s verified identity to site visitors right in the browser’s interface. The findings of our study serve as a reminder for banks to pay attention to their online presence, not only to protect customers from phishing, but also to convey that necessary protections are in place. The good news is that all banks studied had some form of SSL certificate on the home and login pages.”

Added Protection from Phishing

Phishing and pretexting represent 93% of breaches. Phishing is a cyberattack that is designed to fool a victim into believing the phisher is a specific, trusted party for the purpose of stealing credentials, accessing sensitive data, or propagating malware. EV, indicated by a company-branded address bar, helps to increase site transactions and protects users against phishing. EV shows customers that the website employs best-of-breed security measures to protect transactions and ensure compliance with standards and regulations.

Eight out of 10 people report that the presence of EV influences their perception of a brand or company and half indicate it has a significant influence. EV SSL validates that the identity of the certificate owner is reliably authenticated using the best practices available. Before issuing an EV certificate, the issuing CA must perform a specific, audited authentication process using techniques that are proven effective based on a decade of industry-wide use.

Tips for Online Banking Customers

When completing any online transaction or engaging with email, Sectigo recommends that customers:

- Look for the full company name at the left of the address bar to ensure the site is really part of the intended online business.

- Never input credit card numbers, personal information, logins, or other sensitive data on any web page that is not secured with a certificate (as indicated by a padlock in the URL).

- When using email, avoid clicking on links in unsolicited, inbound emails to avoid phishing scams.

About Sectigo

Sectigo (formerly Comodo CA) provides award-winning purpose-built and automated PKI management solutions to secure websites, connected devices, applications, and digital identities. As the largest commercial Certificate Authority, trusted by enterprises globally for more than 20 years, and more than 100 million SSL certificates issued in over 200 countries, Sectigo has the proven performance and experience to meet the growing needs of securing today’s digital landscape. For more information, visit www.sectigo.com.